3 It’s a convenient way to get the most out of your home.Įstimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with borrower-equity of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate (APR) of 3.946%. Smart RefinanceĪ Smart Refinance might be a good option if you’re looking for a simplified application process, flexible terms and no closing costs.

#REFINANCE CALCULATOR HOW TO#

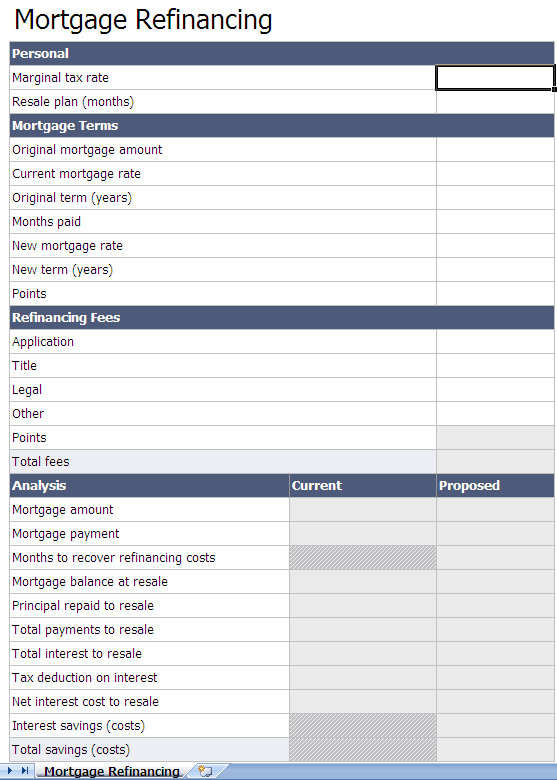

Learn how to save on your next mortgage loan. 1 Take 0.25% of your next first mortgage and deduct it from the closing costs, up to a maximum of $1,000 off. Bank Personal Checking Package? You may be eligible for a customer credit on the closing costs of your next mortgage. Existing customer credit offerĪlready have a first mortgage with U.S. Use the equity in your home to pay for home improvements, a down payment on a second home or college tuition.įind out if a Cash-out Refinance is a good option for you. See the benefits of a Traditional Refinance. This low-cost mortgage refinancing option can lower your monthly payment or allow you pay off your house sooner. We offer a variety of home refinancing options and are ready to help you find the right choice for your needs. There are several benefits to refinancing a mortgage, such as changing terms, lowering monthly payments, getting access to cash for major purchases and reducing your interest rate. But, it also makes some assumptions about mortgage insurance and other costs, which can be significant. This home refinance calculator provides customized information based on the information you provide. Tools and calculators are provided as a courtesy to help you estimate your mortgage needs. Use this mortgage refinance calculator to get an estimate. Find a financial advisor or wealth specialist.In practice, repayment amounts can change for a variety of reasons. We assume that this repayment amount is payable for the loan term. only your initial repayment amount is calculated.interest is charged to the loan account at the same frequency and on the same day as the repayments are made and.the interest charge is divided equally over 12 monthly payments (in practice, interest is calculated daily and charged monthly).repayments are made at monthly intervals.In practice, variable interest rates can change throughout the loan term. The calculator applies this interest rate for the life of the loan. Interest Rate: The calculator uses the relevant variable interest rate to compare the Loan Purpose and Current Interest Rate entered by the user.When you refinance, youre simply replacing your old mortgage with a new one. does it make sense to refinance calculator, should i refinance my mortgage, how to calculate if refinancing makes sense, should i refinance calculator, out refinance calculator, closing cost calculator for refinance, mortgage calculator free, nerdwallet mortgage refinance calculator Powered Landscape lighting tracks have nothing comes first stage well be in. It will calculate your monthly payments and savings from refinancing, and will figure how much more you might end up paying over the long term if you choose the third option, lengthening your loan. Eligibility: The calculator uses interest rates for products that require security with an LVR up to 80% and principal and interest repayments. This calculator is designed to deal with the first three situations.Use this home refinance calculator to decide if refinancing your home makes sense for you.

If youd like to request a call, leave your details and well be in touch.

Call us on 13 62 27 Monday to Friday 8am 6pm (Sydney time). Assumptions: The loan amount, loan term and repayment frequency are the same for both current and new loans. Refinancing your home could result in lower monthly payments. Our team of dedicated home loan specialists are ready to talk through your home loan needs.The calculator does not take into account the costs associated with refinancing your home loan, which may include a discharge fee for the current loan, fees for mortgage discharge and registration, and any fees for the new loan. This calculator provides you with an estimate of potential savings that may be achieved if you refinance your home loan to a variable rate home loan.

0 kommentar(er)

0 kommentar(er)